iowa homestead tax credit calculator

The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is generally based on the first 4850 of Net Taxable Value. In Iowa you must file an income tax return if you made more than 9000 and your filing status is single or if you made more than 13500 and have any other filing statusIf you were a non-resident you must pay Iowa income taxes if you made 1000 or more from Iowa sourcesSince the average household in Iowa makes 58570 annually according to 2017 census data most.

Calculating Inheritance Tax Laws Com

Click on the Save button at the top left of the screen.

. Fill out the application. Rent Reimbursement or Property Tax Credit Rate by Income 1 Iowa Code 42516 through 42540. Budgets for each levying authority are based on its taxable valuation as well as levy limits established by the Code of Iowa.

Iowa Homestead Tax Credit Calculator. Dallas County Assessor - 121 N 9th St Adel IA 50003. January 8 2021 703 PM.

Tax Credits and Exemptions Iowa Department of Revenue. The state offers homestead tax exemptions for seniors and disabled citizens too. Apply online for the Iowa Homestead Tax Credit.

How much are property taxes in Ankeny Iowa. Other Iowa credits and exemptions include the Disabled Veterans Homestead Tax Credit the Military Exemption and the Property Tax Credit for Senior and Disabled Citizens. As with the Homestead Tax Credit the exemption remains in effect until the property owner is no longer eligible.

Homeowners qualify for a property tax. July 1 This credit is calculated by taking the levy rate times 4850 in taxable value. Iowa Ag Land Credit.

Scroll down to the Homestead Tax Credit section and click on the link that states. Home Blog Pro Plans Scholar Login. This credit was established to partially offset the school tax burden borne by agricultural real estate.

Applications must be filed by July 1st of the year the credit is claimed. All land used for agricultural or horticultural purposes in tracts of 10 acres or. Applicants must own and occupy the property as a homestead on July.

You can apply for the Iowa Homestead Tax Credit by filling out Homestead Tax Credit Application 54-028. Confirm that the ownership record is correct you should be listed. Iowa Property Tax Rates.

The answer is 31920. Annual property tax amount. The property owner must live in the property for 6 months or longer each year and must be a resident of Iowa.

P olk County Assessor - 111 Court Ave 195 Des Moines IA 50309. New applications must be made with the Assessor on or before July 1 of the year the exemption is first claimed. The Military Tax Credit is an exemption intended to provide tax relief to military veterans who 1 served on active duty and were honorably discharged or 2 members of reserve forces or Iowa National Guard who served at least 20 years qualify for this.

Madison County Assessor - 112 N 1st St Winterset IA 50273. For additional information and for a copy of the application please go to the Iowa Department of Revenue web site. The credit will continue without further signing as long as it continues to qualify or until is is sold.

How do I estimate the net tax for a residential property with Homestead and Military Tax Credit. Homestead Tax Credit Form. How much is the homestead tax credit in Iowa.

Part of the Homestead Tax Credit in the Iowa Code. Current law allows a credit for any general school fund tax in excess of 540 per 1000 of assessed value. 2 The indexation factor is equal to the percentage change in the GDP Price Deflator from the 2nd quarter.

Jasper County Assessor - 101 1st St N Mech Newton IA 50208. How the Homestead Exemption Works. 150000 Total Value multiplied by 05692 Rollback Rate 85380 Taxable Value 85380 Taxable Value divided by 1000 8538 multiplied by 3521 300623 Gross Tax 300623 Gross Tax minus 58 Homestead Tax Credit 294823 Total Property Tax.

To submit the application electronically click on the Submit. Iowa Tax Proration Calculator Todays dateApril 17 2022. Homestead Tax Credit Sign up deadline.

100 Actual Value x Rollback Rate by Property Class Gross Taxable Value less Military Exemption Net Taxable Value x Consolidated Tax Levy Rate Gross Taxes less Homestead Credit less Ag Land Credit less Family Farm Credit less Elderly Disabled Low-Income Credit Net Taxes Tax Calculation Terms. Advanced searches left. Levy rates are expressed in dollars and cents per 1000 of taxable valuation.

This exemption is worth the taxes calculated on 2778 for WWI veterans and 1852 for all others after that time. Can be used as content for research and analysis. In the state of Iowa this portion is the first 4850 of your propertys net taxable value.

The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is based on the first 4850 of Net Taxable Value. Approved applicants who own a home or mobile home get a credit on their property tax bill. To qualify you must live in the Iowa property you own for 6 months of the year be an Iowa resident and live in the home on July 1.

To qualify for the credit the property owner must be a resident of Iowa and actually live on the property on July 1st and for at least six months of every year. There is a restriction of 40 acres covered under a homestead exemption in rural areas and a limit of 12 of an acre in urban areas. Homestead Tax Credit Iowa residents who own and occupy their dwelling and the land it is located on may file.

Warren County Assessor - 301 N Buxton St 108 Indianola IA 50125. SimplyDesMoines Iowa TaxPro Calculator. Homestead Tax Credit Iowa.

X 03662011 levy 3662011 per thousand. Property tax rates in Iowa are determined annually depending. Iowa residents who own and occupy their dwelling and the land it is located on may file for homestead credit.

Applicants must own and occupy the property as a homestead on July 1st of each year and must declare residency in Iowa for income tax purposes. Homestead Credit is 58. Collected from the entire web and summarized to include only the most important parts of it.

Calculation is as follows. More information about calculating an Iowa homestead credit can be found by visiting the official website of the Iowa Department of Revenue. When it comes to the homestead exemption its up to you to take the initiative.

The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is generally based on the first 4850 of Net Taxable Value. Select if eligible for homestead tax credit. The most common is the Homestead Credit which reduces your assessed value by 4850.

Land Transfer Tax Calculator For Toronto Mississauga And Brampton Home Buyers Agentcashback Com

How To Calculate Sales Tax Video Lesson Transcript Study Com

How To Calculate Net Operating Loss A Step By Step Guide

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

Keep Precise Records Of Rental Income And Rental Expenses For Your Rental Income Business With This Print Business Tax Being A Landlord Business Tax Deductions

Paying Us Expat Taxes As An American Abroad Myexpattaxes

How Much Money Can You Inherit Tax Free Inheritance Tax Calculator Banks 2022 Daily4mative

Self Employed Tax Calculator Business Tax Self Employment Employment

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

Tax Form Pen Glasses Calculator Stock Photo Edit Now 558936394

Dependents Credits Deductions Calculator Who Can I Claim As A Dependent Turbotax

Capital Gains Tax Calculator 2022 Casaplorer

West End St Cloud Mn Real Estate Homes For Sale Estate Homes Long House Home

2021 Capital Gains Tax Rates By State Smartasset

Quarterly Tax Calculator Calculate Estimated Taxes

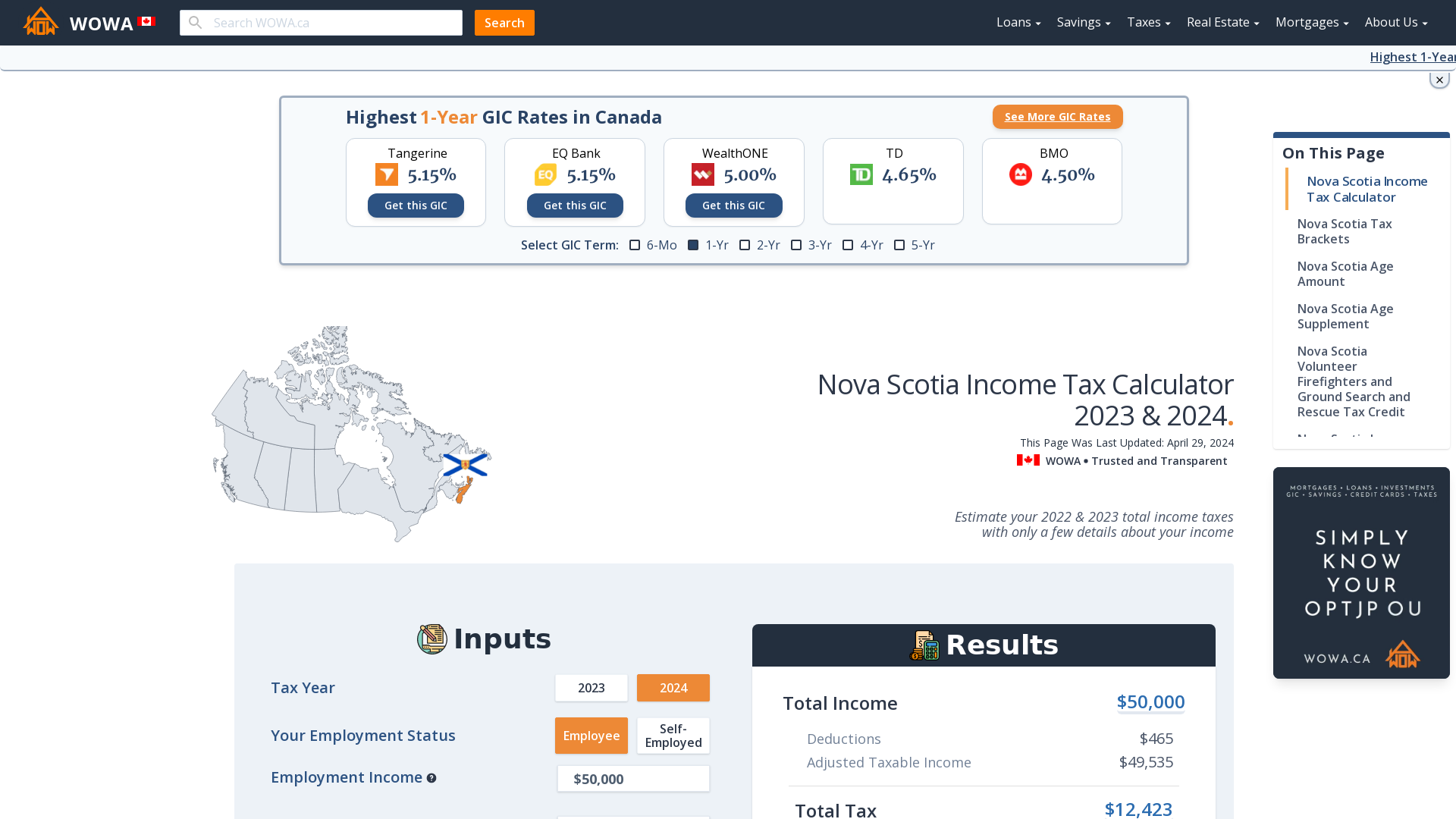

Nova Scotia Income Tax Calculator Wowa Ca

Cryptocurrency Taxes What To Know For 2021 Money