inheritance tax rate indiana

Heres a breakdown of each states inheritance tax rate ranges. Indiana does not have an inheritance tax nor does it have a gift tax.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

If you inherited an immovable property youll also need to pay property taxes.

. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. The top inheritance tax rate is 16 percent exemption threshold for class c beneficiaries. Indiana state income tax rate is 323.

Any more than that in a year and you might have to pay a certain percentage of taxes on the gift. DETERMINATION OF INHERITANCE TAX. However other states inheritance laws may apply to you if someone living in a state with an inheritance tax leaves you money or property.

The top estate tax rate is 16 percent exemption threshold. State inheritance tax rates in 2021 2022. Only 17 states have an additional inheritance or estate tax.

More information can be found in our Inheritance Tax FAQs. No estate tax or inheritance tax. The 1917 amendment provided that gifts made.

Even though there is a state tax assessment there is no inheritance tax estate tax or gift tax. The first inheritance tax law of indiana. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

The top marginal estate tax rate under this proposal would become the highest in the country at 21. You may also contact DOR via email call us at 317-232-2154 Monday through Friday 8 am. It doesnt matter how large the entire estate is.

Estate tax rates vary from state to state. The current tax rate for class a beneficiaries is from 1 to 10. This increases to 3 million in 2020 Mississippi.

The tax rate varies depending on the relationship of the heir to the decedent. Connecticut Estate Tax Guide Updated for 2021. State Inheritance Estate Tax.

As of 2018 an individual can give another person up to 15000 per year as a gift tax-free. No estate tax or inheritance tax. Exemption threshold for class b beneficiaries.

But its a good thing very few will fall victim to it. The top estate tax rate is 16 percent exemption threshold. 430 pm EST or via our mailing address.

The federal estate tax rates can vary between 18-40. The lowest rate is. 100000 or less 7 of net taxable value.

State Inheritance tax rate. The decedents surviving spouse pays no inheritance tax due to an unlimited marital. Overall Indiana Tax Picture.

There is no federal inheritance tax but there is a federal estate tax. Up to 25 cash back Update. Indiana used to impose an inheritance tax.

Transfers to a spouse are completely exempt from Indiana inheritance tax IC6-41-3-7. If the net assets exceed the exemption the excess is then multiplied times the tax rate of 40. Of course this rate is high.

Indiana Department of Revenue. Determination of Inheritance Tax. IC 6-41-5-1 Tax rates.

The tax rate is based on the relationship of the inheritor to the deceased person. In Maryland the tax is only levied if the estates total value is more than 30000. 0 percent on transfers to a.

If you receive a large inheritance and decide to give part of it to your children the 15000 limit per year still applies. For example Indiana once had an inheritance tax but it was removed from state law in. IC 6-41-5 Chapter 5.

Inheritance tax rate indiana. Below are the ranges of inheritance tax rates for each state in 2021 and 2022. For deaths occurring in 2013 or later you do not need to worry about Indiana inheritance tax at all.

Indiana is moderately tax-friendly for retirees. 2010 Indiana Code TITLE 6. Inheritance Tax Rate Indiana.

Rates and tax laws can change from one year to the next. The Indiana law imposed an inheritance tax at progressive rates upon lineal and collateral relatives as well as strangers. Each class is entitled to a specific exemption IC6-41-3-91.

In maryland the tax is only levied if the estates total value is more than 30000. In 2021 the credit will be 90 and the tax phases out completely after December 31 2021. For more information please join us for an upcoming FREE seminar.

Learn Indiana income property and sale tax rates so that you can estimate how much you will pay on your 2021 taxes. Each heir or beneficiary of a decedents estate is divided into three classes. As a result Indiana residents will not owe any Indiana state tax after this date with respect to transfers of property and assets at death.

In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. The estate over the first 500 is taxed at the following rate. While the bills sponsors intend the.

Fortunately Indiana is no longer one of them. Indiana inheritance tax was eliminated as of January 1 2013. It fully taxes withdrawals from retirement accounts and income from public and private pension plans.

In 2012 the. Sales tax in Indiana is 7 with no local sales. While they used to collect an inheritance tax for any inheritance after January 1 2013 there is no separate inheritance tax in Indiana.

Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. Transfers to Classes A B and C transferees Sec. Although the tax rates remain unchanged under sea 293 a 10 credit will be subtracted from the amount of the inheritance tax due for decedents who die in 2013.

The act was amended in 1915 1917and 1919. This tax ended on December 31 2012. The rates for Pennsylvania inheritance tax are as follows.

If you have additional questions or concerns about estate planning and taxes contact an experienced Indianapolis estate planning attorney at Frank Kraft by calling 317 684-1100 to schedule an appointment. Indiana uses a flat tax for income at a rate of 323. A strong estate plan starts with life insurance.

The Iowa tax only applies to inheritances resulting from estates worth more than 25000. No estate tax or inheritance tax. The phase out of inheritance tax will commence in 2013 with a 10 credit being applied.

The state does not tax Social Security benefits. Indiana has a three class inheritance tax system and the exemptions and tax rates vary between classes based on the relationship of the recipient to the decedent. Note that historical rates and tax laws may differ.

A For purposes of this section the net taxable value of property interests transferred by a decedent to. No estate tax or inheritance tax kentucky. DEATH TAXES CHAPTER 5.

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Indiana Estate Tax Everything You Need To Know Smartasset

Indiana Estate Tax Everything You Need To Know Smartasset

Indiana Inheritance Laws What You Should Know Smartasset

New York S Death Tax The Case For Killing It Empire Center For Public Policy

How Do State Estate And Inheritance Taxes Work Tax Policy Center

State Estate And Inheritance Taxes

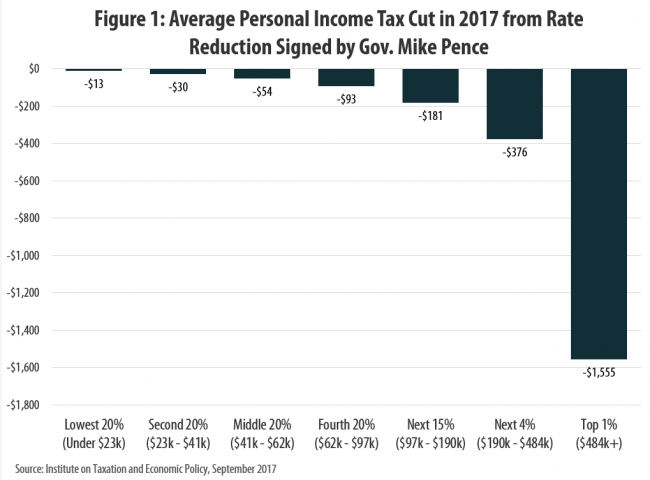

Indiana S Tax Cuts Under Mike Pence Are Not A Model For The Nation Itep

Historical Indiana Tax Policy Information Ballotpedia

How Do State And Local Individual Income Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

2021 Estate Income Tax Calculator Rates

Calculating Inheritance Tax Laws Com

State Death Tax Is A Killer The Heritage Foundation

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Washington Has The Nation S Highest Estate Tax Most States Have Gotten Rid Of The Tax Opportunity Washington